Sanctions on Russia are potentially revolutionary

Sanctions on the Central Bank of Russia are pivotal. They will only work if complemented by oil and gas rationing

The Ukrainian crisis is provoking shifts in Europe that are not short of revolutionary. After shamefully agonizing over sanctions, the EU and especially Germany seems to be going full circle and embarking on a level of sanctions, and combativeness that was hard to imagine just a few days ago.

This is also probably augmented both by Ukraine’s show of force on the ground and the impeccable leadership of President Zelensky as well as by Russia’s apparent failing blitzkrieg and substantial domestic resistance to the war.

It is important however to break down the effectiveness of various levels of policy intervention and their likely effect and consequences.

I. Sanctions: The international monetary system always trumps the payments system

SWIFT exclusion is useless if not complete

· On the sanctions front, it is incredible to observe how the attention has quickly focused politically on SWIFT. Somehow, in the eyes of non-experts, SWIFT became the most powerful and politically expedient way to cut off the Russia banking system from the international financial system

· But as my friend Zoltan Poszar puts it, the international payment system is just the international supply chains in reverse. It is not possible to cut off Russia from the international payment system unless one is prepared to cut it off from global supply chains, in our case from energy supplies to Europe.

· Net natural gas importers are well aware of this fundamental tension and that is why they were not prepared to cut off Russia from SWIFT but eventually caved in to agree a “targeted and functional” SWIFT exclusion, which with the carve-outs defeats the whole point of the exclusion.

· Indeed, if Sberbank is barred from SWIFT and can’t transact in dollar with foreign counterparties, but Moscow Bank can take the payment and then net it out with Sberbank, the SWIFT exclusion is useless.

· This is why even the GL-8 exclusion from the first batch of US sanctions that were banning dollar transaction (theoretically far more powerful than SWIFT) remain teethless if all energy transactions are exempted as clearly outlined by Adam Tooze.

Central bank assets freeze is the nuclear weapon

· With the decision to Freeze assets of the Central Bank, the US, EU, have effectively cut off Russia from the international financial system and worse they have entirely crippled Russia’s ability to use its foreign exchange reserve to fend off sanctions.

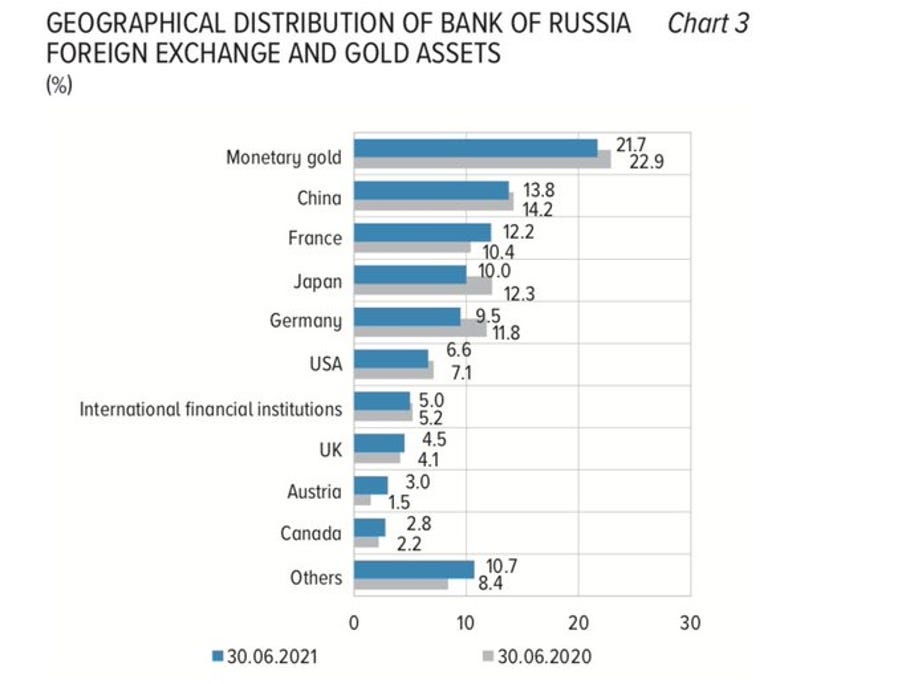

· The Central Bank of Russia holds nearly USD 630bn worth of reserves, which were accumulated as warchest precisely to be able to endure financial trade and financial sanctions of the sort imposed in 2014-2015.

· This is a different order of magnitude altogether because it essentially neutralizes a large part of the reserves held by Russia. Indeed, most of these reserves held in the form of securities, deposits and gold assets are custodied abroad and are used by way of investment banks that serve as agents of the CBR.

· If these assets can’t be used, they severely undermine the CBR’s ability stabilize its exchange rate and meets its international payment obligations.

· However, what matters are the share of these deposits that are effectively under the reach of these sanctions.

· This is reminiscent of the weeks leading up to France’s 1940 defeat against Nazi Germany where the Banque de France and the French Navy deployed heroic efforts to evacuate the gold reserves of the Banque de France precisely to preserve France’s ability to fight the war. Russia is learning the hard way that this also holds true in the Bretton Woods II world of fiat currency.

· There are however three critical questions to the effectiveness of these sanctions:

o Their actual implementation and the degree to which Russia will be able to mobilize reserve assets held in more friendly jurisdiction (China for example)/

o The legal battle that will ensue, which could eventually force the freeze to be relaxed.

o The flow of fresh hard currency proceeds that are coming from current gas and oil sales (currently running at some 20bn per month as per Robin Brooks). This wholly depends on the EU’s ability to ration gaz in Europe and there is litte discussion of that yet.

· It’s hard to underestimate the importance of this set of sanctions if properly implemented. It could indeed provoke a domestic financial crisis that would bring Russia to its knees.

o Markets testing the fire power of the Central Bank of Russia and its ability to defend de RUB, with potential fire sale of RUB for hard currency probably driving the currency to levels not seen since the late 1990s.

o Hard currency shortages leading to nationwide Bank runs that could quickly become systemic, leading to a complete collapse of the banking system and credit creation.

o The resulting would provoke debt monetisation and a sharp rise in inflation for all imports, and particularly western ones (luxury goods and tech), which will quickly become once more unavailable to ordinary Russians.

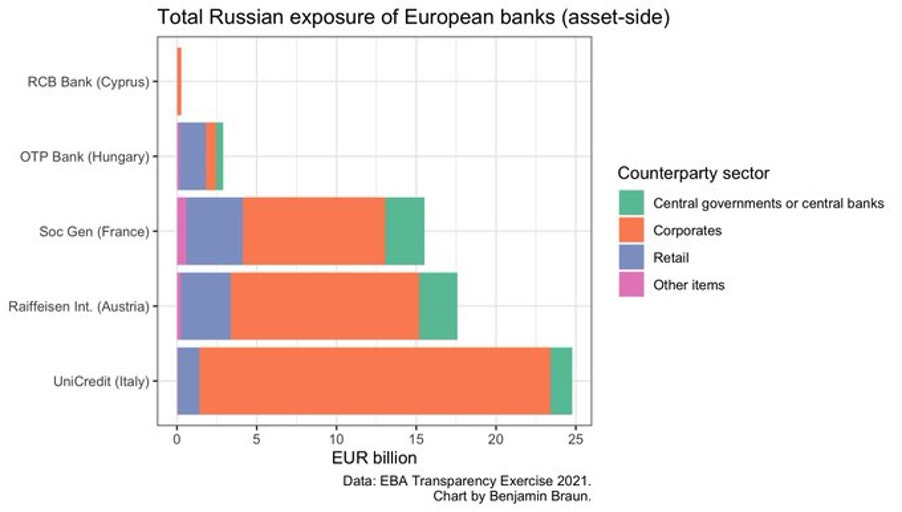

o This would nonetheless feedback into the world economy through several channels. A complete stop in Russian imports, a stop in Russian FDI abroad and more important a series of default on international Russian debt. European banks would be particularly exposed.

o These events would undoubtedly lead to a multi-year recession, deeper and more-broad based than in 2014

II. A German Revolution Under Way

· The extraordinary session of the Bundestag over the weekend is nothing short of revolutionary. The fact it is taking place under the leadership of an SPD Chancellor is all the more striking, the fact that it seems to be met by popular support (500,000 people walking in the street of Berlin) and transpartisan consensus in the Bundestag makes it profound.

· Russia’s network of influence, collusion, corruption patiently built in Western Europe over Putin’s 25 year reign seems to be collapsing right before our eyes in a matter of days. It is this collapse that is sending shivers in Moscow and that likely provoked Putin’s raising the nuclear trump card.

· Nearly every German taboo has been broken over the weekend:

o Arming Ukraine with possibly some 500 stingers missiles, 1000 heavy anti-tanks rocketsbvorr which will have to take place with the active participation of Poland, France and other allies is probably the best possible starting point to build Europe’s strategic autonomy.

o The EU has announced that it will pay for Ukraine weaponry suggesting yet another pooling of resources is underway, and that Germany will certainly be a major contributor to the effort.

o Germany is prepared to entirely overhaul its Army and spend 100bn on it in 2022. This seemed wholly implausible just a week ago and even though it might be operationally impossible to spend so much in so little time, it marks a degree of political commitment.

o Germany is also now committed to 2% of GDP defense spending as per NATO commitments and it will place German troops in Eastern Europe with a political mandate to defend “every inch of NATO territory”.

· All in all, it is still somewhat unclear whether these moves in Germany will converge towards rebuilding NATO or whether it is the first step towards a genuine European defense. In any case, a conversation initiated by Macron a couple of years ago and that had led nowhere, is now right in the center of Europe’s political agenda.

· It is notable that for the first time, Europe will support Ukraine including militarily. This is both a symbolic precedent and is going to be very significant in size with some EUR 500m committed so far. It will operate through the EU’s Peace Facility, a new facility enacted just a year ago.

III. European consequences: Another crisis leap

A fiscal tide that lifts all boats

· The European Commission had prepared a communication on the reintroduction of the European Fiscal rules that was meant to be announced this week. It is near certainty that this will be shelved given the profound changes to the fiscal outlook that these announcements made.

· With a golden rule for defense spending in preparation in Germany, it will be hard to avoid a golden rule for climate spending. The sum of these could change quite radically the fiscal stance for Europe starting this year but also over the medium term.

· Germany’s fiscal stance, which was only modestly more accommodative because of the coalition agreement will become sharply expansionary. It is also quite probable that the spending necessary to withstand possible disruptions in natural gas supplies are not yet budgeted and could be substantial. The short-term and almost inevitable fix at this point will be to reverse the decision to close all nuclear power plants in German this year.

· I wouldn’t be surprised if they are kept running throughout this government and if Germany considers building new ones by the end of it. The central question however in the short-term will be that of natural gas supplies, which remains Putin’s critical leverage and source of revenues to finance the war effort.

· It is hard to conceive Europe being successful in its strategy without cutting gas and oil imports very soon. This would require taking over Gazprom’s 12 storage facilities in Europe, it would force rationing consumption, switching coal and nuclear power plants and use LNG facilities far more intensely.

· This conversation has not really started while it is critical to address the political and financial leverage Russia hold over the EU.

Monetary policy must follow

· What is striking against the backdrop of this somewhat revolutionary set of decisions is that the ECB seems to be sticking to a fairly conservative view. Speeches by Board Members in the coming days are going to be critical.

· Isabel Schnabel’s speech two days ago is probably already outdated but had opened the question of the sequencing of the normalization process (but only to close it immediately by suggesting that the reinvestment policy of both the APP and PEPP programme offered enough flexibility).

· The ECB need to show immediately that it is ready to accompany the bold fiscal commitments that are being made at present and fulfill its secondary mandate of supporting the general policy of the EU. A central bank hiding being its inflation mandate in a situation of war would be (should be) stripped of its independence.

· If it doesn’t do it because it has changed its view of the macroeconomic outlook. It must do it because the current financial conflict will necessarily result in great financial strains for the European banking system. Indeed, the total exposure of European banks to Russia is relatively small but concentrated in a few banks creating potential financial stability risks that must addressed by the ECB.

Conclusion

The European failure to agree to SWIFT sanctions without exclusions that made useless has forced a far stronger policy response in the form of Asset freeze of Russia’s central bank.

This is major break in the international monetary order created with Bretton Woods II. Central Bank reserves are now worth as much as the the dominant reserve currencies issuing them want to. This could have profound long term consequences.

Europe’s decision to arm Ukraine and to arm itself is a tectonic shift that ought to provoke others.

None of the revolutionary steps are worth anything if the EU cannot free itself rapidly of Russia’s oil and gas imports. This will require heroic efforts.