SGP reform: News from Berlin, Brussels and Frankfurt

The ECB is making the boldest and clearest call for reforms of the European Fiscal Rule. It profoundly alter the fiscal / monetary policy cooperation framework

I remain quite concerned about the uncertainty of the Euro Area policy outlook in 2022 (ECB PEPP taper, and fiscal policy uncertainty), but I have to acknowledge that there are some quite important movements taking place in the background in Berlin, Brussels and even Frankfurt.

In Berlin, the coalition negotiations are slowly converging to a set-up that is disappointing for those like me who expected a real political discussion about a constitutional reform but that may nonetheless yield important policy change.

· While it appears accepted by all parties that Christian Lindner of the FDP will become Finance Minister, he has been compelled to sound both open about the need for Green investments and even more open about European fiscal rules reform than he ever was.

· The big fight however lies with the demand of the Greens for annual 50bn EUR carve out for Green investment. The devil is in the details here and whether this is financed by the Federal Budget, off balance sheet vehicles or the KfW will matter greatly. Watch out both for a clear number per year throughout the legislature, the way green investments are defined and for the way in which it would be financed.

· Finally, the macro-economic discussion may not have been lost altogether. And the astute campaign of Dezernat Zukunft and Philippa Sigl-Glöckner (a former aide to Finance Minister Scholz) to revise some parameters of the existing German Constitutional Debt Brake in particular the output gap calculation and the “cyclical component” could also yield significant room for maneuver, without changing the constitutional debt break.

Interestingly, the intellectual consensus on these issues has shifted quite considerably in the German public debate. Perhaps the most illustrative example of that is the last report of German Council of Economic Experts (Sachverständigenrat), who has not seen a new President appointed after the end of the term of Lars Feld and therefore for the first time issued an annual report presenting both a conservative and a progressive view on the issue of fiscal rules, when the progressive view used to only be a dissenting opinion. The progressives are calling for:

· New expenditure benchmark rule (that limits the procyclicality),

· Golden rule to safeguard public investment

· Revision of the 1/20th debt reduction rule that they find inoperable and undermining for the credibility of the framework.

They are effectively for a deep reform of the European framework.

In Brussels, the calls for reform of the Fiscal Governance are mounting despite the total absence of progress in the last 2 years but the debate is starting over again.

· The European Commission initially tabled to introduce legislative changes at the end of 2021 and has since stepped back. Many in Brussels argue that one of the reasons why Brussels is backtracking is because they feel limited support and ownership for an ambitious agenda in Paris. Indeed, while many hoped that the French rotating presidency of the EU would be the opportunity for Macron (possibly alongside Draghi) to stage a real campaign (my view is this will not happen).

· The Commission seems therefore rather intent to offer a more limited reform agenda, some of which could lead to legislative changes but most of it being delivered through a new communication in the spring of 2022 in time for 2023 budget planning. The focus would be:

· Soften the debt reduction rule that forces a reduction of the debt in excess of 60% of GDP by 1/20 per year (leading to very significant nominal adjustments).

· Change the way structural efforts benchmarks are calculated so as to reduce the required structural adjustment (modification of output gap calculations)

· Introduce a carve out allowing governments to spend more on green investments. This could be largely inspired by the existing flexibility in the pact that exists for structural reforms or investments (introduced in 2015) and could lead to a simplication of the flexibility matrix. Here the precedent of the EU disbursing the RRF on the basis of validation green plans submitted to the Commision via National Recovery and Resilience plans has created a useful precedent.

The European Fiscal Board, which has led the charge over the last few years for an ambitious reform of the Stability and Growth Pact has repeated its plea for a reform revolving around a differentiated expenditure benchmark, while questioning the decentralisation of monitoring and enforcement by National Fiscal Councils. The new European Fiscal Board (EFB) recommendations suggest a reform of the 1/20th rule in favour of a country-specific debt adjustment path.

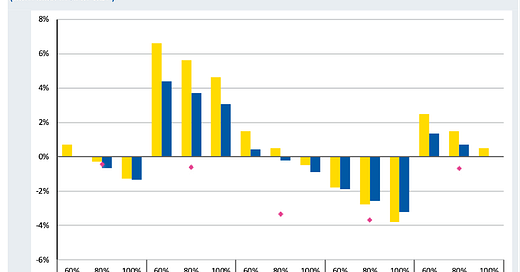

The European Stability Mechanism has recently come out with a set of reforms rooted also in an expenditure benchmark but has also focused its attention on the debt reduction rule, which it views as the most problematic (although not only) problem. The ESM rightly shows that changing the reference debt/GDP level from 60% to 100% and the path of adjustment from 1/20th to 1/30th could make the adjustment path a lot more sustainable but it rightly points to the different legal obstacles ahead.

Indeed, the 3% and 60% reference values that form the basis of the corrective arm of the pact in Article 126(2) are quantified in Protocol 12 of the Treaty (TFEU). These could be amended by an EU Regulation based on the TFEU Article 126(14). This would require unanimity in the European Council but would not be subject to national ratification. Changes to the Treaty and Protocol 12 can normally be made only through formal treaty revision, via the ‘ordinary’ ‘simplified’ procedure.

The one twentieth rule is specified in Regulation 1467/1997, as well as in the TSCG and could therefore be more challenging to amend without national ratification. The ESM provides for an interesting legal remedy by offering a joint interpretative declaration by its signatories mutually agreeing to a (temporary) suspension of the operation of certain provisions of the TSCG pursuant to Article 57 of the 1969 Vienna Convention on the Law of Treaties.

It is striking that the European Commission is more timid in this way than both the European Fiscal Board but also than the European Stability Mechanism. It continues to face resistance from a frugal coalition (that is weakened by signs of opening in the Netherlands and Germany) and by the lack of a real set of sponsors for an ambitious reform agenda.

In Frankfurt, there is also a movement spearheaded by Philip Lane that might in fact be decisive. Change started with Schnabel and Lagarde openly calling for reform of the SGP in a direction that would enable more public investment and stabilization. This is now complemented by a “personal” proposal by the ECB’s Chief Economist Philip Lane suggesting reform in three ways, one of which is potentially revolutionary:

1. Sustainability by essentially reforming the 1/20th debt reduction rule by essentially stretching the debt reduction from 20 to more than 30 years and to consider the annual reduction over a 5-year moving average rather than 3.

2. Macroeconomic stabilization by essentially moving to an expenditure rule, which would reduce the reliance on output gap and would therefore reduce the procyclical nature of the current structural adjustment based framework.

3. Fiscal – Monetary policy cooperation, where Lane brushes a framework where the fiscal authority would effectively have more space when inflation is running below the ECB’s inflation target. This would ensure greater macro-fiscal policy coordination and improve the ability of the ECB to meet its mandate, while holding fiscal policy back when inflation runs durably above the target.

This last proposal is potentially revolutionary both economically and institutionally by radically changing the interaction between fiscal and monetary policy. This idea was in fact first proposed in 2016 by Claeys, Darvas and Leandro and developed more rigorously by the ECB and discussed extensively as part of the Strategy Policy Review. It reveals the extent to which the ECB’s thinking is evolving on fiscal / monetary cooperation. It will be important to monitor the extent to which the idea sails through the Executive Board and the Governing Council.

All in all, while we are nowhere near a real leap in fiscal framework reform (hence my enduring concerns about the fiscal stance in the short term), there are now a broad set of converging forces that push for a more daring reform agenda than I had expected a few months ago. They may not yield results soon but they are likely to tilt the intellectual consensus profoundly.