The cost of an oil & gas embargo for Europe and the necessary policy response

Europeans will have to cut their dependence on Russian gas and pay the price for it

The decision by the United States to ban oil and energy imports from Russia yesterday was critical. It results from a number of domestic policy dynamics especially the fact that Senator Manchin (from Virginia, a coal state) and Murkowski (from Alaska, an oil state) were going to impose a ban in a bill that would have and forced the hand of the administration. This will surely see some increase in energy prices domestically, but the US is a net oil & gas exporter after all, so this was an easy decision to make. This gives the US the moral high ground while having the added benefit of putting the Europeans and in particular the Germans under tremendous pressure.

This is reminiscent of the US attitude during the 2014/2015 Russia-Ukraine conflict where the US administration was systematically stepping up its sanctions ahead of European council meetings to force the hands of the Europeans leaders. Europe remains highly divided on the issues given the costs involved with an aggressive Russian energy embargo but if they are not forced to act by public opinion, Russia could well take the lead and impose its own energy export ban. So far the Energy Minister has threatened to cut oil & gas supplies. The Kremlin has announced yesterday of ban of commodities’ exports until the end of the year but it is not clear yet whether and to what extent energy is covered by it.

A potential energy embargo raises fundamental economic questions for Europe. According to Bruegel, energy independence from Russia could be achieved within a year. The European Commission’s own communication suggests only 2/3rd reduction is possible within a year with a series of bold steps that would be quite transformative for the European energy markets and infrastructure.

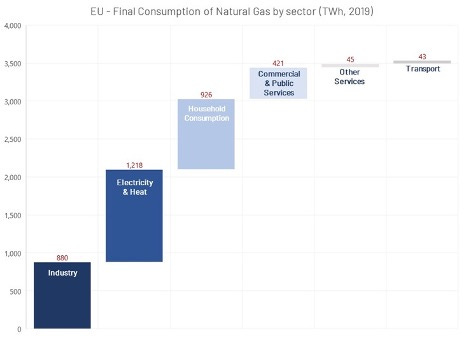

That being said the Europeans are not readily acknowledging that achieving energy independence right now would necessarily require severe demand destruction.Silvia Merler at Algebris on the basis of Bruegel’s data does the math and shows that destroying natural gaz demand by almost 40% would be required. Aurora energy research produces a more detailed analysis of options to replace Russian gas that suggest an 11% perfect drop in demand in would be necessary, and this is doesn’t mention the possibility of nuclear or coal substitutions. The uncertainty is therefore quite considerable about the range of gaz demand destruction that needs to take place and its effect on the European economy.

This raises acute questions about the size and the about the distribution of these demand reductions to minise the effect on GDP. Goldman estimates calculates that even with a rational rationing (rationing the sectors that are the most energy intensive first), the effect on the European economy could be quite significant. For 2022 as a whole, high gas prices could weigh on Euro area GDP growth by 0.6pp relative to the baseline forecast. The impact in Germany is likely to be even greater (-0.9pp) due to its high reliance on Russian gas. In the event of a complete shutdown of imports from Russia, see Euro area GDP growth fall by 2.2pp in 2022 relative to the baseline, with sizable impacts in Germany (-3.4pp) and Italy (-2.6pp). Robin Brooks from IIF’s estimates are a touch lower.

The ECB’s Economic Bulletin of January 2022 runs simulations with an economic model of 10% natural gas rationing shock suggesting an economic effect on the euro area GDP to the tune of 0.7% of GDP but this ignores price effect. A price shock of the magnitude currently experienced would suggest a 0.2% of GDP shock per quarter as per the same bulletin. Rationing and the current price shock would therefore at the very least reduce GDP by at least 1.5% of GDP according to the ECB.

Older research sponsored by the JRC on the basis of a DGSE model about the effects of an energy price shock on the European economy suggest something a larger magnitude. A $30 per barrel price shock would reduce the EU’s GDP by 2.6%. While, we can’t really extrapolate linearly, this would imply a much more significant shock than currently estimated by the ECB.

The large uncertainty around this shock and possible mitigation measures is creating profound unease in European capitals, and justifying the great reluctance to act.That being said, all Member States are all planning some contingency measures. Germany has already announced a series of steps, France is also announcing that it will increase its storage capacity by 15%, diversity its suppliers and prepare measures to reduce energy consumptions for households and the industry.

What is becoming clear is that the size of the shock will require a bolder economic policy response than what has been currently announced. So far, the draft European Council conclusions for the Versailles Summit are extremely timid both on the reduction of energy imports from Russia and as a result, also on the size and form of an economic policy response package. The European Commission communication has restated its openness to interpret flexibly support measures to shelter consumers and corporations from a spike in energy prices and reminded Member States of the ongoing suspension of the European fiscal rules.

European leaders will have to take critical decision at the European Council this week that should include:

A clear call to Member States to prepare contingency planning to reduce their energy consumption by as much as 25% if necessary. These contingency plans should establish strategic priorities and targeted measures by industry.

A clear commitment to treat temporary support measures introduced by Member States favourably in the context of the European State Aid rules.

A call to set up a large new borrowing capacity of at least 100bn EUR with two objectives:

A new European defence fund that could bolster the EU’s common defence and armament capacity.

A new facility to invest in critical pan European energy infrastructure to assist the process of diversifying energy supplies and accelerating energy transition.

A call to suspend the fiscal rules beyond 2022 and at least until a new agreement on a reformed European Economic governance emerges. This would kill two birds with one stone, relax fiscal constraints in the short term and force Member States and the European Commission to commit to a real timeline for delivering a new fiscal framework.

Given, these fiscal commitments, the ECB should carry on its accommodative policy at least until the effects of the current war and its economic ramifications are more fully understood and measured.