The German plan to respond to the energy crisis and its fiscal consequences

The bold German plan will make the return to the debt brake in 2023 unachievable

The announcement by the German Government of a third package of measures to help cushion the German economy against rising inflation in general and energy prices in particular is economically and politically very significant.

The measures announced are said to be in the range of EUR 65bn gross (more than 1.6% of GDP). However, the net amount could be smaller and the total gross amount is also somewhat dependent on the actual cost of certain measures that will only be known ex-post depending on the evolution of energy prices.

Indeed, while the headline figure announced by the Government is EUR 65bn, the government says –in a low voice – that it will continue to meet the German Debt Brake in 2023. While, this is wholly implausible, it is a fiction that can only be sustained by forecasting higher fiscal revenues but also attributing a very substantial yield to the two revenue generating measures in the plan: (i) immediate implementation of the OECD minimum corporate taxation agreement, (ii) windfall tax on energy companies.

All in all, this announcement by Germany is very substantial in that it will free/force greater fiscal activism across Europe. It might also embolden the ECB to act more forcefully.

The plan

I. Expenditure

There is big discussion taking place at the moment about reforms of the European electricity market to essentially address the problem caused by marginal pricing, which leads to electricity prices trailing gaz prices. This debate has been raging for more than a year with recurrent proposals to reform the electricity market being opposed by the European Commission and to a large extent by the German government. Indeed, the merit order framework is one that in principle encourages the greater investment in renewables by offering large windfalls.

European market intervention

There is great reluctance to change that very framework and the German plan in fact only opens the door to short-term measures but not to a fundamental overhaul of the European electricity pricing framework. In this sense, it is wholly consistent with the European Commission Non paper and the proposals that are likely to be agreed by the European Energy Ministers Council meeting this week,

The instruments currently under discussion in the EU are intended to contribute to reducing energy prices throughout Europe. Temporary revenue ceilings for power generation plants with a low cost base (inframarginal producers) are actively being discussed by the COM but Germany doesn’t seem intent on advocating structural reforms of the market.

Domestic market electricity market

Germany is effectively introducing three important reforms to its domestic electricity market

1-Electricity price brake

By a providing a basic quantum KWh of energy at discounted rate to all German households

2-Reduction of on-grid charges

These charges were set to increase in January 2023 and are going to be reduced.

3-Domestic Emission Trading

The German government will forego the 5 euro increase in the domestic CO2 market/tax that was scheduled in January 2022. All subsequent annual increases will be postponed by 1 year, in a clear sign that carbon taxation/pricing is being rolled back.

Pensioners

Pensioners are to receive on December 1st 2022 an energy price flat rate of 300 euros. This corresponds to a relief of around six billion euros. This complete freezing of energy prices for pensioners is substantial and its cost will vary greatly based on actual energy prices during the winter.

Students

All students and technical school pupils are to receive a one-time payment of 200 euros.

Benefits and social security contribution

· Minimum citizen’s allowance is to be increased to 500 euros with regular updates to adjust for inflation throughout the year rather than only annually.

· Cut in social security contribution for mini jobs up until 2000 euros (costing 1.5bn)

· Increase in child benefits by 18 euros per kid.

· Housing benefit recipients are to receive a one-off heating cost subsidy in the autumn amounting to 415 euros for a one-person household (+100 euros per individual in the household).

· Encourage bonuses rather than pay rises in wage negotiations by providing social security contribution relief to bonuses.

Business support

· KfW loans for business in difficulty

· Peak energy support scheme for energy intensive companies that cannot pass on cost or reduce demand estimated at some EUR 1.5bn

II. Revenues

The figure of 65 billion euros the government unveiled Sunday to deal with the crisis includes contributions from the federal government, states and municipalities. The federal component of the latest plan is about EUR 40 billion. But there are only two revenue generating measures to finance the plan: (i) immediate implementation of the OECD agreement on a minimum corporate tax rate, (ii) windfall tax on energy companies.

Immediate implementation of the OECD agreement on minimum corporate taxation

That would allow the Federal Ministry of Finace to tax at a minimum of 15% international profits of German companies. Most estimates consider that this would raise slightly less than EUR 10bn. This is potentially a very important step also in that it will force implementation by other countries that were dragging their feet.

A new windfall revenue tax for energy companies

The German government is advocating for at the European level but says it is prepared to implement nationally. But one should not underestimate the difficulty of coming to a European agreement on the matter given the national idiosyncrasies of each national energy market.

For example in France, the combination of the ARENH regulated price for nuclear electricity that forces EDF to sell nuclear energy at capped price combined with the Service Public de l’Energie scheme that caps the energy price of renewables are such that there are in fact very little windfalls for domestic energy producers.

There are however windfalls from energy producers from their international operations but that would be a wholly different matter. It is therefore difficult to imagine a sensible windfall tax scheme at the European level.

In any case, Germany must be planning on very large revenue between 10 and 20bn EUR per year to finance the plan. In the absence of such revenues, it will be impossible for the German government to credibly commit to meeting the obligations of the Debt brake in 2022.

Indeed, the budget planning for 2023 proposed in July 2022 to the Bundestag was planning an ambition to return to debt break in 2023 (In an interview with Süddeutsche Zeitung, September 6, Lindner now says that he could imagine suspending the debt brake if it is constitutional though he really does not want to as long as it is not desperately needed so budgetary planning will carry on for now with the view to meet the debt brake.

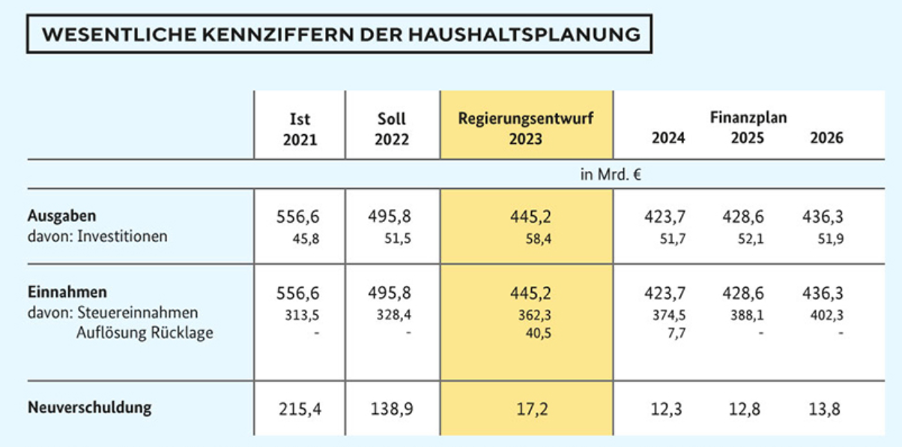

The July budgetary plan was suggesting EUR 9.9 billion new debt for 2023 under the debt break + EUR 7.3 billion financial transactions (outside of the debt brake calculation), which means EUR 17.2bn in new debt.

The third relief package worth EUR 65 billion is supposed to only count for EUR 32 billion towards the Federal Budget divided in EUR 8 billion for 2022 and EUR 24 billion in 2023.

According to Finance Minister Lindner, the EUR 8bn for 2022 can be financed off of improved revenues and 10 out of the 24bn for 2023 as well (ie. increased revenues and 5bn of earmarked crisis fund). This leaves 14 billion for 2023 unaccounted thus far and therefore likely to be in excess of the debt brake (unless it can be absorbed by the cyclical component of the rule depending on the economic out-turns in 2023). This will be the object of intense discussions in parliamentary debates in the coming weeks but neither the Greens nor the SPD seem intent on calling the bluff of the Finance Ministry.

Given the expansion of fiscal voodooism in Germany, it will be difficult but critical to understand three critical points to assess the true fiscal impact of the new plan and the extent to which it forces a rewriting of the constitutional debt brake or the extension of the suspension for another year (which has already been agreed at the EU level, but which the German government continues to resist):

o What will be the true expenditure of the plan given the uncertainty around certain measures such as the “Strompreisbremse” (electricity price brake) or the Wohngeldreform (reform of housing contributions for low incomes)?

o How credible is the EUR 32bn number being floated and to what extent does it rely on revenues (corporate tax and windfall tax)?

o How much transfers from the Federal Government to the Landers and Municipalities will be necessary to implement the plan and how much that will lead to revision of the fiscal rules (Länderfinanzausgleich)

All in all, the boldness of the plan is commendable. It is fairly well designed on the expenditure side barring perhaps the total freeze of energy prices available to pensioners, but the windfall tax on which the finance of the plan rests appears difficult to agree at the European level and unlikely to yield the sort of revenues expected.

The consequences of this are two-fold:

Fiscal expansion in Europe in 2023 will be significant and will contribute to lessen inflation and its effect on economic activity. This is the right course of action and should make the ECB more relaxed.

But it might instead embolden the ECB's Governing Council to take more aggressive monetary policy tightening actions.

Not sure I understand why a fiscal expansion should “lessen” inflation. As fiscal expansion is supposed to support nominal income, should not the opposite be the case?