Zombification and Corporate Debt Overhang in Europe

ECB and government prepare to act to address corporate debt overhang

Dear All,

There has been an acute discussion in France about the treatment of the public debt accumulated during the COVID crisis and the possible need to consider debt cancellation. The ECB was forced to weigh in and flag the risks and the legal challenges that a debt write-off operation by the Central Bank would provoke.

The question of private debt, rather than public, cancellation is just about to start. Indeed, the ECB has issued a note on the risk of Zombification of the corporate sector and this is likely to become a more pressing policy focus. The ECB tries to give a clear definition of what is a zombie firm building on the approach of Storz et al. (2017)[5]. Zombie firms are those firms that meet all of the following three criteria over two consecutive years:

(i) Negative returns on assets (net income over total assets), identifying unprofitable firms;

(ii) Low debt servicing capacity (earnings before interest, taxes, depreciation and amortisation (EBITDA) over financial debt of below 5%), capturing indebted firms;

(iii) Negative net investment (annual change in total fixed assets), to avoid capturing young firms.

The concerns expressed by the ECB are liable to encourage policy action on two fronts that should be monitored closely:

I. The SSM is likely to tighten lending standards and encourage banks to provision loans to these firms more aggressively. In addition, the SSM could also encourage European banks to revisit the question of NPL management, Asset Management companies, and the European resolution framework. These issues have been dormant since the last push around the Italian and Greek banks but might renew policy attention.

II. Governments might be compelled to consider various schemes to proceed to some level of “triage” between good and bad companies to avoid zombification and support more actively firms that could recover.

I will be writing more specifically about questions related to supervisory measures, AMCs in a separate note but in the short-term, action is more likely to come from Member States in a form of debt-to-equity swap to erase quite meaningful amounts of Europe’s corporate debt.

Indeed, during the negotiations of the Recovery and Resilience Facility, the Commission had proposed a “Solvency Instrument”, which was meant to redress the fact that not all Member States had the fiscal space, tools, and experience in managing support to the private sector. The instrument was meant to empower and back the European Investment Bank to provide equity or equity like financing to struggling companies whose viability could be proven.

This was eventually rejected by the Member States who preferred to bolster the Grants part of the Recovery and Resilience Facility instead. As a result of the absence of European instrument, the backing of the European corporate sector has largely been a domestic affair.

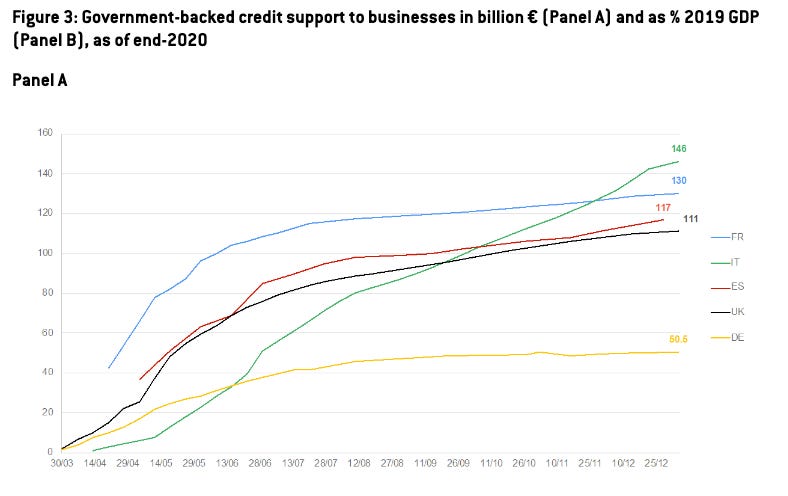

Early in the pandemic, the European Commission set guidelines for access to loan guarantee schemes[1]. Each country eventually put in place its own eligibility criteria. But in countries that have extended vast amounts of guarantees or loans to their corporate sectors, the treatment of this debt overhang for the private sector will become critical in the coming months/years.

In the months running up to the submission of the National Recovery and Resilience Plans, a group of countries (France, Portugal and Greece in particular) wanted to make “solvency instruments” part of the Recovery plans proposals but the European Commission had mixed views about it and feared blanked debt cancellation that would violate State Aid rules and encourage rather than avoid zombification.

In the absence of a European led effort, or the standardization by way of the approval of the National Recovery and Resilience plans, Member States will be left once to their own devices to devise plans to arrange debt forgiveness -- often disguised as debt to equity swaps policies). There are already quite advanced discussions in France about converting part of the guaranteed loans into equity for solvent firms (See this note by Blanchard and Pisani-Ferry or this one by Bernard Cohen-Hadad.

However, this process is highly uncertain and subject to abuse and undue subsidies. First, it’s hard to evaluate case by case solvency in such an economic context and companies that may be deemed insolvent could rebound when activity picks up and conversely, companies that are fully solvent may not require debt reduction of any form. What are described as debt-to-equity swaps might therefore hide blanket subsidies that would not fundamentally deal with the problem of zombie firms but would cut corporate debt levels and relieve banks’ balance sheets to some extent.

Source: Bruegel (2021)

For the moment, the numbers mentioned are small and would only concern the 10% of firms the most at risk but this could set an important precedent. The real question is whether this policy that is likely to be experimented in a few countries will spread across Europe, in which case we should expect an overall increase in public debt and reduction in corporate debt. This is more a public to private debt swap rather than a true debt to equity swap.

[1] requiring that firms should have reported EBITDA interest coverage ratios greater than 1 and debt-to-equity ratios below 7.5 for both of the last two reporting years